There has never been a good time to add travel insurance to your trip plans, especially now that the Omicron variant of Covid has added more uncertainty to travel.

Whether you’re preparing a long-awaited vacation or a last-minute getaway, travel insurance can save you money, time, and frustration if something goes wrong. We looked at 46 different plans to find the best travel insurance.

What Is Travel Insurance Covered?

Comprehensive travel insurance policies include some valuable benefits. You can also purchase policies that only cover trip cancellation or medical expenses.

With such a broad variety of plans available, you can find coverage levels that suit your budget and trip requirements. In a comprehensive plan, look for these top coverage options.

Insurance for trip cancellation

You don’t plan a trip to cancel it, but illness, injury, family member sickness, jury duty, and other factors can all derail plans.

If you have to compensate for a cause detailed in the policy, trip cancellation insurance will reimburse you in full for any money you have lost in pre-paid, non-refundable deposits.

If you are concerned about Covid, you can find travel insurance policies covering Covid-related trip cancellation if you contract the virus shortly before your trip. It’s a good idea to insure the total amount you’ve put down in non-refundable and pre-paid deposits.

Refundable amounts, such as refundable plane tickets, should not be insured because insurance covers them.

Medical insurance for travel

This is a critical coverage for travellers going abroad, where your U.S. health plan may provide limited or no coverage.

Travel medical insurance covers ambulance service, doctor and hospital bills, and other medical expenses incurred while on the trip.

You can find generous coverage limits of up to $500,000 per person while depending on your trip, and you may not require that level of coverage.

Travel medical insurance is essential for senior travellers because Medicare does not pay for health care outside the United States, except in minimal circumstances.

If you are concerned about Covid, you can find travel insurance policies covering Covid-related medical expenses if you contract the virus while on the trip.

Coverage for emergency medical evacuation

This is also critical coverage for those travelling abroad, especially if you’re going to a remote location where quality medical care may be challenging to find by.

Emergency medical evacuation insurance will cover the cost of transporting you to the nearest appropriate medical facility.

You can find adequate coverage of $1 million per person. Coverage for “cancel for any reason.”

You may be able to increase your trip cancellation insurance coverage to “cancel for any reason” (CFAR).

This best feature is not available from all service providers. Having it allows you to cancel your trip for any reason that isn’t covered by your standard policy. You could, for example, cancel the trip because you no longer want to go.

Reimbursement under a CFAR claim is frequently 75 percent of your trip costs rather than the total amount available under the base trip cancellation coverage.

CFAR adds an average of 50% to the cost of an insurance plan.

Travel delay insurance

Travel delay insurance reimburses you for expenses incurred if you are stranded somewhere and must purchase necessities to tide you over.

For example, if you’re stuck in an airport for the entire day due to a weather delay, this coverage can reimburse you for necessities like snacks and toiletries.

If you’re stranded for an extended period, it could cover the cost of a taxi, a hotel night, and meals travel insurance reviews.

Best Travel Insurance Companies in 2021

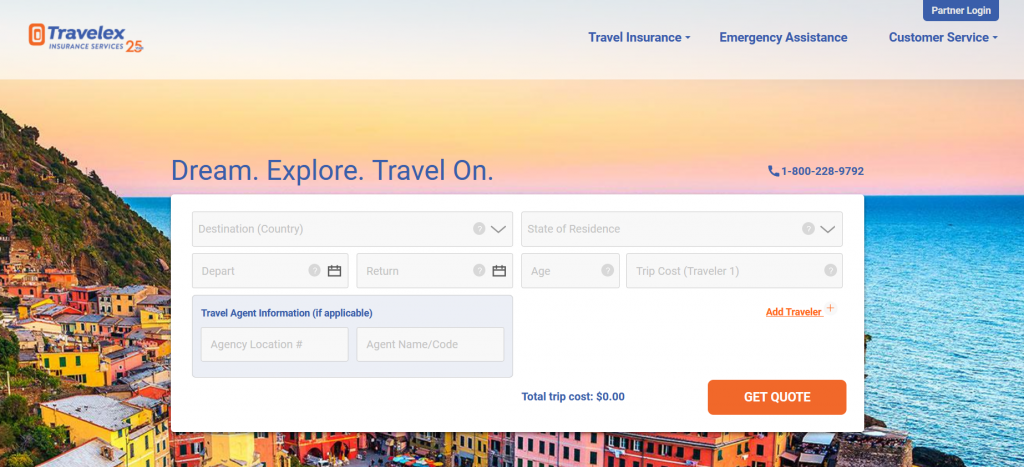

1. Services Provided by Travelex Insurance

Pro: Upgrades such as car rental coverage, additional medical insurance, and adventure sports coverage are available.

Con: The Travel Basic plan does not include adventure sports or additional medical coverage.

Travelex offers two main plans of travel insurance: Travel Basic and Travel Select. With optional add-ons, you can also tailor your policy to meet your specific needs.

If you’re looking for a low-cost plan, consider the company’s Travel Basic plan. This plan pays out 100% of the insured trip cost for cancellations and interruptions and up to $500 for trip delays.

It also provides up to $100,000 in emergency medical evacuation and repatriation coverage, $15,000 in emergency medical and dental coverage, or $500 in baggage and personal effects coverage.

You also have access to primary coverage with no deductibles.

The company recommends this plan for short domestic vacations. If you’re going on an international travel trip, the Travel Select plan is a good option.

This plan has generous limits: up to $500,000 in emergency medical evacuation and repatriation coverage, $50,000 in emergency medical and dental coverage, and $1,000 in coverage for lost, damaged, or stolen baggage and personal effects.

Furthermore, children aged 17 and under who travel with an insured adult are covered at no extra cost.

Travelex also provides custom upgrades, such as car rental coverage and accidental death and dismemberment insurance, that you can add to your plans.

If you purchase travel insurance within 15 days of your initial trip deposit, you can add a preexisting condition waiver to your Travel Select plan.

You can also add adventure sports coverage to the Travel Select plan, such as mountain climbing, skiing, or scuba diving. Travelex also allows usaa travel services you to buy a travel insurance policy, request policy documents, and file a claim online costco life insurance reddit.

2. Allianz Travel Insurance

Advantage: Annual and multi-trip policies are available.

Con: Differentiating between the company’s ten travel insurance plans can be difficult.

Allianz Travel Insurance offers a variety of ten travel insurance plans designed to meet the needs of different types of travellers.

You can buy coverage for a typical trip. Still, if you travel frequently and avoid purchasing a new travel insurance policy each time, you can also buy an annual travel insurance program.

Allianz provides several levels of coverage when it comes to purchasing travel insurance for a specific trip.

While each plan has its inclusions and coverage limits, the OneTrip Prime plan is the most popular single-trip plan travel health insurance.

You can earn up to $100,000 in trip cancellation coverage, $150,000 in trip interruption coverage, $25,000 in emergency medical coverage, up to $1,000 in baggage loss, theft, or damage, and $500 in change fee coverage with OneTrip Prime, among other benefits.

The one trip Prime plan also includes free coverage for children ages 17 and under when travelling with a parent or grandparent, and you can customise it with extra coverage for rental cars or preexisting conditions.

You can also apply for a travel insurance quote, file a claim, manage your policy, or follow up on a claim online with Allianz travel insurance companies.

Furthermore, the insurance for trips company trip insured provides a smartphone app to manage your plan from your preferred mobile device.

Customers can also call a 24-hour hotline if they have any problems.

3. Travel Insurance for World Nomads

Advantage: Adventure sports are included at no additional cost.

Con: The standard plan only provides up to $2,500 in trip coverage.

World Nomads offers customizable travel insurance policies that vary in coverage and cost based on your requirements.

Its policy inclusions are extensive, and unlike other travel insurance companies, it includes adventure sports such as scuba diving, mountain biking, bungee jumping, and skiing in its standard policy.

When you apply for a free quote from World Nomads, you’ll have the option of selecting one of two travel insurance plans: the Standard Plan or the Explorer Plan.

The Standard Plan offers less coverage for a lower upfront cost, whereas the Explorer Plan offers more comprehensive coverage for a higher premium.

The Standard Plan, for example, only provides $2,500 in trip protection coverage, whereas the Explorer Plan guarantees $10,000.

Both plans include $100,000 in emergency medical coverage, but the Standard Plan includes $300,000 in emergency evacuation coverage, while the Explorer Plan includes $500,000 in coverage inext travel insurance reviews.

Other types of coverage (with varying limits) included with both plans include trip cancellation, trip interruption, loss or harm to baggage and personal effects, rental car coverage, accidental death and dismemberment, and more insurance for trips.

World Nomads insurance health travel allows you to easily apply for a quote online, as well as file a travel insurance claim.

4. AIG Travel Insurance

The coverage of your travel insurance policy is tailored to your specific trip.

Con: Without first obtaining a quote, it isn’t easy to get information about policy coverage inclusions.

AIG Travel provides three types of travel insurance plans: the Annual plan, which covers all trips within a year, the Pack N’ Go plan, which covers last-minute trips; and the single-trip plan (of which three levels) purchase travel insurance online.

Single trips can be insured with Essential, Preferred, or Deluxe level coverage, depending on the cost of the journey and the amount of guaranteed reimbursement.

If you live in New York, you can choose from a similar Silver, Gold, or Platinum plan based on your needs. The amount of coverage and the limits in your plan may differ depending on the specifics of your trip.

Because of this variation, it is critical to obtain a quote through the AIG Travel search engine to confirm the coverage levels you are eligible.

AIG travel insurance plans and travel insurance international typically cover children under aged 17.

With a mid-tier Preferred plan, you may be eligible for trip cancellation coverage for up to 100% of the cost of your trip (up to $150,000) and trip interruption coverage for up to 150% of the cost of your trip (up to $225,000).

Depending on the insurance for traveling details of your trip, medical expense coverage of up to $50,000 and trip delay coverage of up to $800 can be included cheap travel insurance international.

While AIG Travel provides limited information about its plans before requesting a quote, it does make it very easy for customers to file a claim or check the status of a travel insurance claim online travelinsuredinternational.

5. Seven Corners

Advantage: Preexisting condition coverage

Con: If you cancel your coverage for any reason, you will be charged an additional fee.

Best travel insurance Seven Corners provides travel insurance plans for residents of the United States, but it also provides travel insurance with medical coverage for visitors travelling to the United States.

Travel medical coverage plans with up to $5 million in coverage can be purchased. Still, there is also travel insurance for students, group travel insurance plans, and annual travel insurance plans for frequent travellers.

The featured travel insurance plan from Seven Corners is RoundTrip Trip Cancellation Insurance, which is the type of policy you might buy to cover a single vacation you have planned for the year claim tripadvisor listing Travel Insurance Companies .

This coverage is just available to residents of the United States and comes in three tiers: economy, choice, and elite nationwide company.

The following are a few international travel insurance of the primary benefits of the mid-tier RoundTrip Choice plan worldwide insurance:

- Trip cancellation coverage of up to $20,000 is available.

- Trip interruption coverage is available for up to 150 percent of the trip’s cost.

$600 in trip delay coverage

- Coverage for lost connections is valued at $1,000.

- Up to $100,000 in emergency medical coverage

- Up to $750 in emergency dental coverage

- Up to $500,000 in emergency evacuation and repatriation coverage

- Baggage coverage of up to $1,500 for lost, stolen, or damaged baggage

This level of coverage can include any preexisting conditions as long as you buy your plan within twenty days of your first trip deposit and meet other requirements.

Also, insurance travel when you purchase a plan from Seven Corners, you can customise it with add-ons such as rental car coverage, flight accident coverage, and cancel for any reason coverage.

6. IMG Travel Insurance

Pro: A plan specifically designed for retired travellers aged 65 and up.

Con: The iTravelInsured Travel Lite plan does not include primary coverage.

Travel medical insurance, international health insurance, and traditional travel insurance are the three main types of coverage offered by IMG Travel Insurance best travel insurance best weather providers.

This company also offers a GlobeHopper Senior plan for retired travellers 65 and older and programs tailored to ex-pats, students, business travellers, insure for travel and government employees life insurance travelers.

ITravelInsured Travel Lite, iTravelInsured Travel SE, and iTravelInsured Travel LX are the three main travel insurance plans offered by IMG for families and business travellers.

Its mid-tier iTravelInsured Travel SE plan is a family-friendly travel insurance plan that can be used for both domestic and international trips.

You will receive the following benefits if you purchase this plan primary travel insurance or Travel Insurance Companies:

Trip cancellation coverage of up to $50,000 per person is available.

Travel delay coverage of up to travel health insurance cost $500 (maximum of $125 per day) Trip interruption coverage of up to 150 percent of trip cost

Up to $500,000 in emergency medical evacuation coverage

Change fee reimbursement of up to $150

This plan can be purchased up to one day before your trip.

Surprisingly, boundaries quotes trip delay coverage can cover a wide range of expenses, such as extra kennel fees for a pet or costs associated with family internet usage.

You can also add rental car damage protection worth up to $40,000.

You’ll also have access to a few non-emergency travel benefits, such as coverage for a supplier’s financial default (for example, a hotel that goes bankrupt before you arrive) and coverage for the theft or loss of a passport, which prevents you from departing aaa traveler magazine.

7. Generali Global

Pro: Coverage for sporting equipment is included in the company’s mid-tier plan.

Con: Preexisting condition coverage is only available on the Premium plan.

Generali Global Assistance provides three travel insurance plans that you can tailor to your specific needs: a Standard plan, a vacation insurance Preferred plan, and a Premium plan of Travel Insurance Companies.

Its Standard domestic travel insurance usa plan offers the least coverage, whereas the Premium plan offers more range and higher limits for a higher initial cost.

The Preferred plan offers the same coverage as the Standard plan but with added protection for sporting equipment and sporting equipment delays.

As a result, if you are travelling for a golf tournament or a ski trip, this plan is an excellent choice.

Meanwhile, is travel insurance worth it reddit best travel insurance companies the Premium plan provides the most comprehensive coverage for more expensive trips, such as tours and cruises.

Among other benefits, cf travel insurance this enhanced plan promises 100 percent reimbursement for trip cancellation, 175 percent reimbursement for trip interruption, $2,000 in baggage coverage per person, and $250,000 in medical and dental coverage per person Travel Insurance Companies.

You can quickly obtain the best free quote from Generali Global Assistance, and you can file travel insurance claims online or over the phone.

You can purchase coverage as early as 18 months before your trip’s departure date or as late as the day before your departure date.

8. AXA Assistance USA

Advantage: All plans include coverage for lost or disconnected connections.

Only the most expensive plan allows travellers to cancel for any reason coverage.

For customers who want to pay more (or less) for the right amount of coverage, AXA Assistance USA offers three tiers of travel insurance (Silver, Gold, and Platinum).

The Gold Plan is AXA’s mid-tier option, with 100 percent trip cancellation coverage, 150 percent trip interruption coverage, $200 per day trip delay coverage ($1,000 maximum benefit), $1,000 in missed connection coverage, $500,000 in emergency medical evacuation coverage, and $100,000 in accident and sickness coverage.

The trip insurance Gold Plan also includes $300 in baggage delay coverage and $1,500 in baggage and personal effects coverage.

However, you can pay more for more coverage and higher coverage limits with the Platinum Plan or choose the more cost-effective Silver Plan.

The Platinum Plan also includes specialised coverage for active travellers, such as coverage for lost ski days ($25 per day), $500 in range for failed golf rounds, and $1,000 in sports equipment rentals.

Furthermore, this level of coverage is the only AXA plan that allows you to add cancel for any reason rider to your policy, which will enable you to receive up to 75% of your trip costs back if you decide to cancel your trip.

(Please keep in mind that for this coverage to apply, it must be purchased within 14 days of your initial trip deposit.)

AXA Assistance USA holiday inshurance plans also include a 10-day money-back guarantee.

This means you can buy a plan, change your mind, and get your money back if you haven’t start your trip or filed a claim.

9. Berkshire Hathaway Travel Insurance

Pro: All plans include 24-hour travel assistance to help you find or replace lost luggage as well as lost or stolen wallets, tickets, and passports american and foreign insurance company.

Con: Some benefits, such as preexisting condition coverage, are only available if the plan is purchased within 15 days of your first journey deposit.

Berkshire Hathaway Travel Protection allows you to choose from various travel insurance plans and get a free online quote in minutes.

Not only does the travel insurance with medical company provide travel insurance for flights or cruises, but it also provides three levels of coverage for your vacation: ExactCare Value, ExactCare, and ExactCare Extra.

The company also provides specialised plans for adventure travel, holidays insurance road trips, cruise travel, and other activities.

The mid-tier ExactCare plan from Berkshire Hathaway is best for families, and it includes:

Trip cancellation coverage worth up to 100% of the trip cost

Trip interruption coverage is available for up to 150 percent of the trip cost.

Trip delay coverage of up to $1,000 is available.

Up to $25,000 in medical coverage

A medical evacuation worth up to $500,000 is available in an emergency.

Missed connection coverage of up to $500 is available.

Please note in mind that all Berkshire Hathaway Travel Protection plans for individual trips include 24-hour, seven-day-a-week global travel assistance.

This can be highly beneficial if your wallet is lost or stolen, you require emergency translation services, you lose your passport while abroad, or you experience other travel mishaps.

Berkshire Hathaway tripadvisor travel insurance makes it simple to file a claim online through its online portal, and you can also view and manage your policy details online.

Berkshire Hathaway also advertises that it pays claims five times faster than the industry average, which is something to consider if you are concerned about delayed claims and reimbursement times.

10. HTH Travel Insurance

Pro: Comprehensive coverage at the mid-tier level.

Con: Only mid- and high-tier plans offer pre-existing condition coverage.

With HTH Travel Insurance, customers have a variety of options to meet various objectives.

You can purchase medical-only coverage for a single trip or multiple trips, as well as the standalone trip cancellation coverage.

HTH Travel Insurance provides supplemental travel insurance comprehensive travel insurance coverage in addition to a range for specific aspects of your trip.

Plans are divided into three categories: economy, classic, and preferred.

The Classic plan offers up to $25,000 in trip cancellation coverage, 150 percent of trip cost coverage for trip interruption, up to $1,000 in baggage and personal effects range, $200 in baggage delay coverage, up to $1,000 in trip delay coverage, up to $250,000 in sickness and accident coverage per person, and $1 million in medical transportation coverage, among other benefits Travel Insurance Companies.

The Preferred plan has even higher limits for those looking for more coverage, including up to $50,000 for trip cancellation, 200 percent of the trip cost for trip interruption, $500,000 in medical for illness and injury, and more.

The Economy plan is probably best for less expensive trips closer to home due to low coverage limits in some categories.

You can also add range for preexisting conditions to the Classic and Preferred plans if you purchase your policy within 14 days (Classic) or 21 days (Preferred) of your initial trip deposit.

Trip cancellation insurance

This is valuable coverage if you have to cut your trip short due to a reason listed in the policy.

It may reimburse you for non-refundable portions of your trip that you do not use, such as a resort stay or a pre-paid scuba diving lesson. If you have an emergency, you can also pay for a last-minute one-way ticket home.

Coverage for baggage and personal effects

A foreign travel insurance trip can be ruined if your bags are misplaced. Baggage coverage can help to alleviate some of the financial stress.

It can reimburse you for bags, clothes, and shoes that never arrive, but keep in note that the reimbursement is for the depreciated value of the items, not the cost of purchasing new ones. It also compensates for items stolen is flight insurance worth it reddit.

Baggage delay coverage

Your bags may be taking a detour of their own, but what do you do while you wait? This coverage reimburses you for expenses incurred while waiting for your luggage.

For example, you might need a coat, a hat, and some toiletries if you’re visiting Canada. Most policies require a certain amount of time to pass before baggage delay coverage kicks in, such as six hours.

How Much Does Travel Insurance Cost?

The cost of the best travel insurance is typically based primarily on the age of the travellers and the cost of the trip. Of course, transamerica.com the plan and provider you select will impact the cost.

Here’s an example of how much the top plans in our ratings cost Travel Insurance Companies.

Best travel insurance plans

The average cost

- Trawick International First Class Travel $344

- GoReady Pandemic Plus $390 iTravelInsured Travel SE $396 Nationwide Mutual Insurance Co. Prime

- $409 AXA Assistance USA Platinum $417 Cat 70 Travel Plan $432 Tin Leg Gold $432 TravelSafe Classic $463 HTH Travel Insurance TripProtector Preferred

- $473

- Choice of Seven Corners RoundTrip $478

- Diamond USI Affinity Travel Insurance Services

- $498

- Gold John Hancock Insurance Agency $548

- AIG Travel Guard Deluxe costs $688.

The average price is based on rates for five different trips with various traveller ages.

It is important to note that plans have varying benefits best Travel Insurance Companies, which can account for price differences.

Is Travel Insurance Necessary?

Here are few reasons why you might require travel insurance:

If you cancel the trip, you could lose a lot of money in non-refundable deposits.

You won’t have trip cancellation coverage.

It will reimburse you for the entire reason of pre-paid money you will lose if you cancel for one of the reasons specified in the policy.

You’re going on a plan abroad, but your health coverage doesn’t cover you there.

Many health plans lack comprehensive global coverage or impose high out-of-network deductibles for care received outside the United States.

Check the specifics of your health plan to see what it includes.

The gap is filled by travel medical insurance. You’re going to a remote location.

Even minor harm can turn into a significant medical event if you aren’t close to any quality medical facilities.

Medical evacuation coverage will pay for a medevac to a suitable facility. You require emergency backup.

Travel insurance includes 24-hour travel assistance lines that can help you find a pharmacy, translate a language, replace a lost passport, and much more pet assure Travel Insurance Companies.

Methodology

Using data from Squaremouth, a travel insurance comparison site, we scored 46 policies to find the best travel insurance plans. When a company had more than one high-scoring plan, we chose the highest score medical companies.

Medical expenses, medical evacuation, pre-existing condition exclusion waivers, “cancel for any reason” coverage, Covid coverage, trip interruption, baggage delay time requirements, travel delay time requirements, baggage reimbursement hurricane and weather coverage requirements, financial default of a travel supplier were among the benefits scored.

Best Travel Insurance Companies Frequently Asked Questions

What exactly is travel insurance?

What does travel insurance not cover?

I’m most concerned about becoming ill while travelling.

What kind of insurance should I get?

Is travel insurance required for a cruise?

Is travel insurance available for multiple trips?